In this article, I’ll explain about Zerodha account opening through the online & offline account opening process. This is a step by step process for Zerodha account opening covering all about account opening documents, charges & much more.

If you are NRI (Non-resident Indians) then you have to follow separate procedures for Zerodha account opening. We have also written an article on Zerodha NRI Demat & Trading Account Opening, You can read here.

- Free Investment (No Delivery Brokerage)

- Free Mutual Fund Direct Investment

- Innovative Investment Products (Smallcase, Coin, etc.)

- Low Brokerage & Charges

- Comprehensive Educational Resources (Zerodha Varsity)

- User-Friendly Trading Platform (Kite)

- NRI Account Opening Facility

- Advanced Charting Tools and User Interface

- No Hidden Charges

- Stock Research Report Not Provided

- Order Placement Issues during high volatility.

Zerodha is now the largest discount broker in India with over 1.5+ million customers base having a daily turnover of over Rs. 50,000+ crores over NSE, BSE, MCX, and MCX-SX. Charges levied by Zerodha are also nominal & they provide a very decent advanced trading platform.

All equity delivery investments (NSE, BSE), are absolutely free — ₹ 0 brokerage. All direct mutual fund investments are absolutely free — ₹ 0 commissions & DP charges.

Flat ₹ 20 or 0.03% (whichever is lower) per executed order on intraday trades across equity, currency, and commodity trades. Flat ₹20 on all option trades.

I recommend you to opt for the online method while opening your account with Zerodha as it’s faster & hassle-free. It looks like there are too many steps involved but it’s not the case. This will hardly take more then 15-20 minutes if you have all the documents handy.

Zerodha Online Account Opening Process (Using Aadhar-Fast)

Now let’s get started with Zerodha Demat & Trading account opening Process. First understand, what you will be needed to open a new account.

Online Zerodha Account Opening Documents

You are required to submit these documents for the zerodha account opening.

- Pan Card

- Aadhar Card (For Online Account Opening)

- Personalized Cancelled cheque or Front Page of Passbook [Bank Proof]

- Passport photos

- Scanned Signature

- Bank statement Last 6 month (Optional)

You need to keep the above-mentioned documents handy. In case, if you don’t have these above documents ready. You can also signup for the Zerodha account opening process. Later, you can continue from where you left off.

Zerodha Account Opening Charges

If you want to open an offline account in Zerodha then you need to pay Zerodha Demat account charges as :

| Transaction | Charges |

|---|---|

| Trading Account Opening Charges (One Time) | Rs 0 |

| Trading Annual Maintenance Charges AMC (Yearly Fee) | Rs 0 |

| Demat Account Opening Charges (One Time) | Rs 0 |

| Demat Account Annual Maintenance Charges AMC (Yearly Fee) | Rs 300 |

Zerodha has made online and offline account opening free for resident Indian accounts from 29th June 2024.

AMC (Account maintenance charges)

- For BSDA demat account: Zero charges if the holding value is less than ₹4,00,000.

- For non-BSDA demat accounts: ₹300/year + 18% GST charged quarterly (90 days).

To learn more about AMC, Click here

Zerodha Sign up Account Opening (New Process Online)

1. Phone no. Authentication

2. Enter PAN Card Details

3. Signup for Digilocker Account

Click on ‘Connect to DigiLocker’ and this will open a new page to sign up to Digilocker using your phone number. If you already have an account, click on ‘Sign in’ option in the bottom.

While connecting the Digilocker, you will be receiving the OTP to your AADHAR linked mobile number for your information. Once you get the OTP, enter it and hit continue.

4. Enter your Personal Details

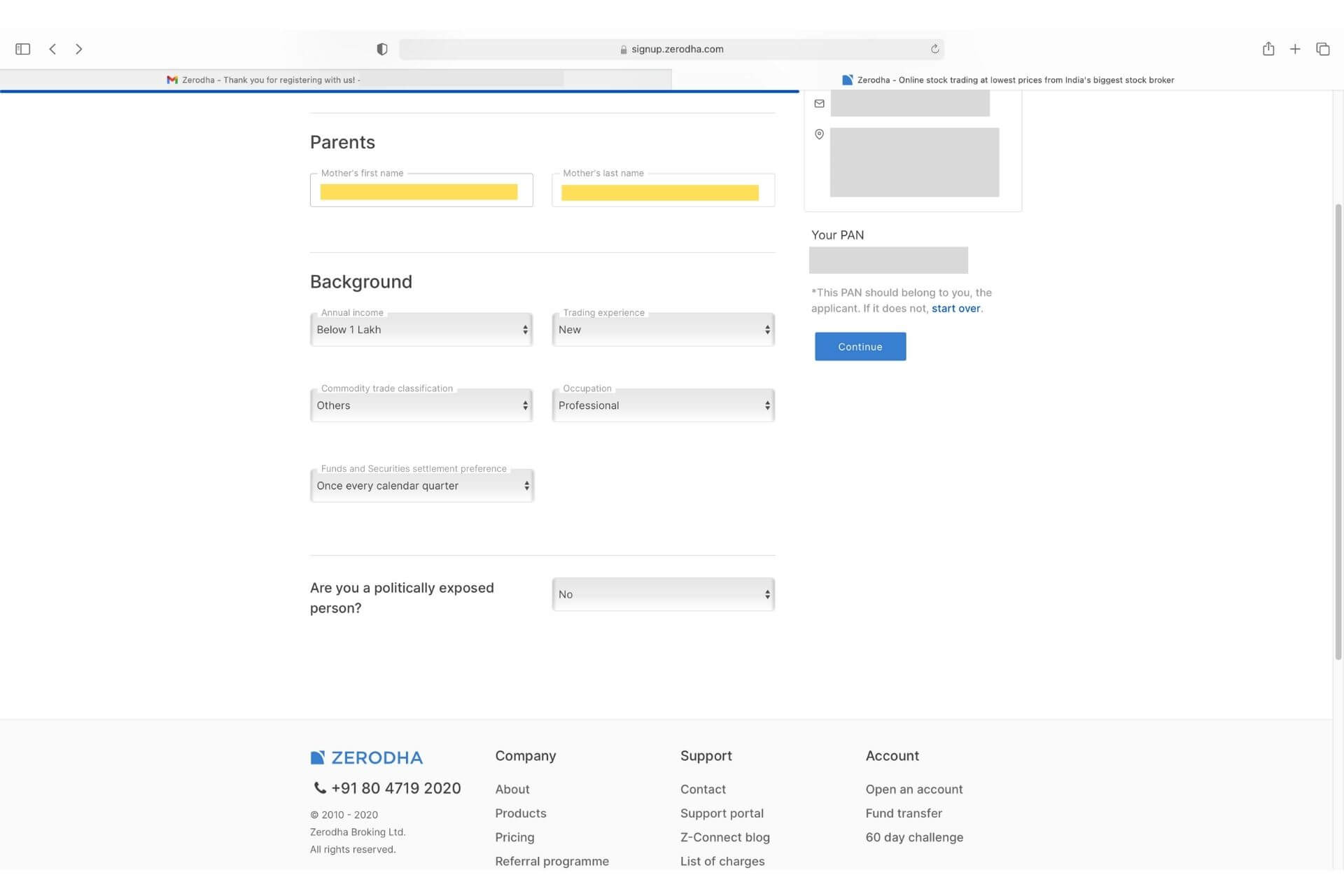

Once your Aadhar verification is complete, next you need to enter your personal details like father’s name, mother’s name, your occupation, etc. After entering the details, click ‘Continue’

5. Enter KYC details

6. Complete the IPV (In-person verification)

7. Uploading Zerodha Account Opening Documents

8. Aadhar E-Sign Account Opening Form

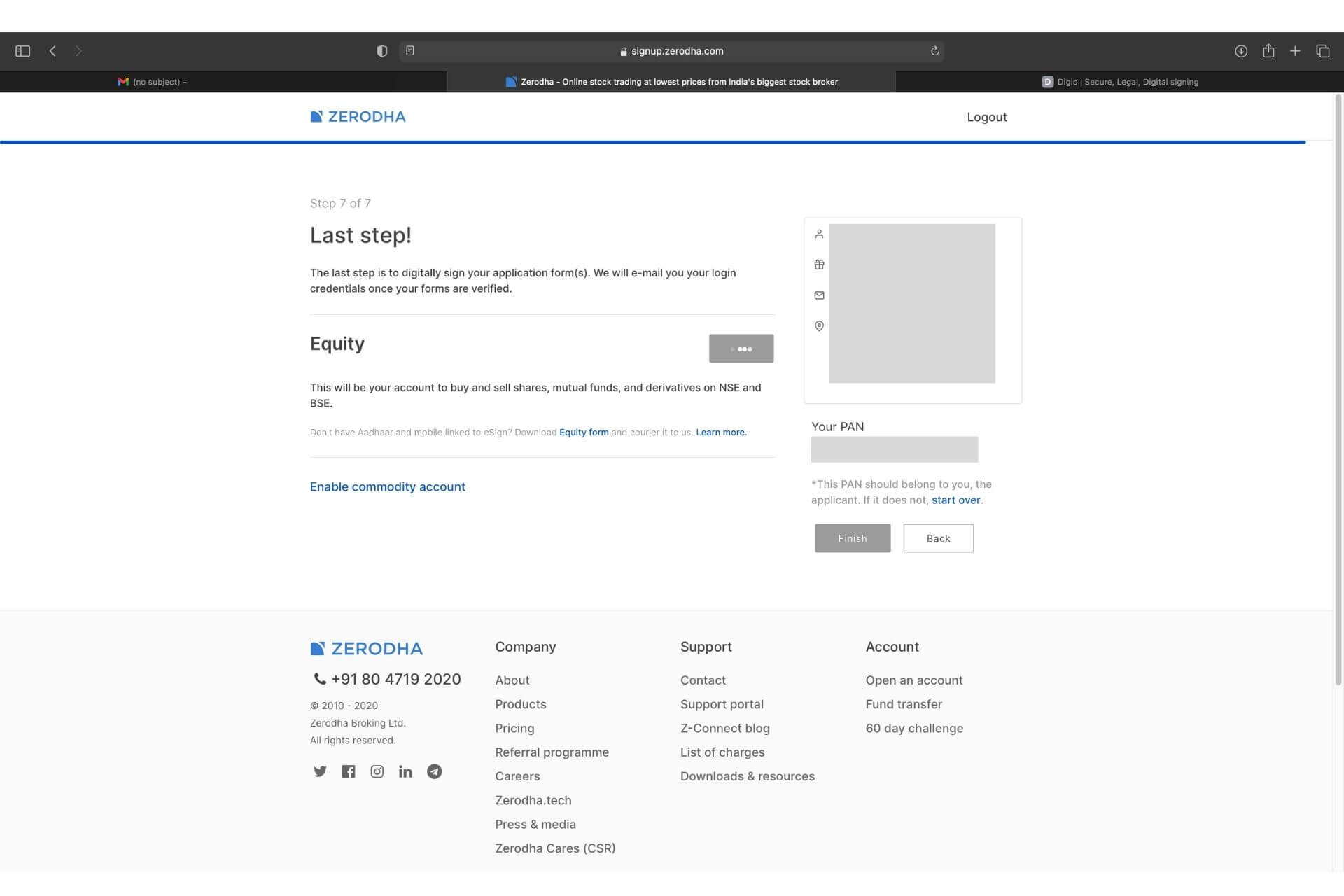

Next, it’s time to eSign. Click on ‘eSign Equity’ button and proceed to the next step.

9. Verify your Email

After you click on eSign equity, you need to verify your email. You can log in with Google or your email.

If you choose email, make sure to enter your email correctly because you will get a code to verify it. This email will also be where you get future messages from Zerodha.

10. Sign Now

10. Sign Now

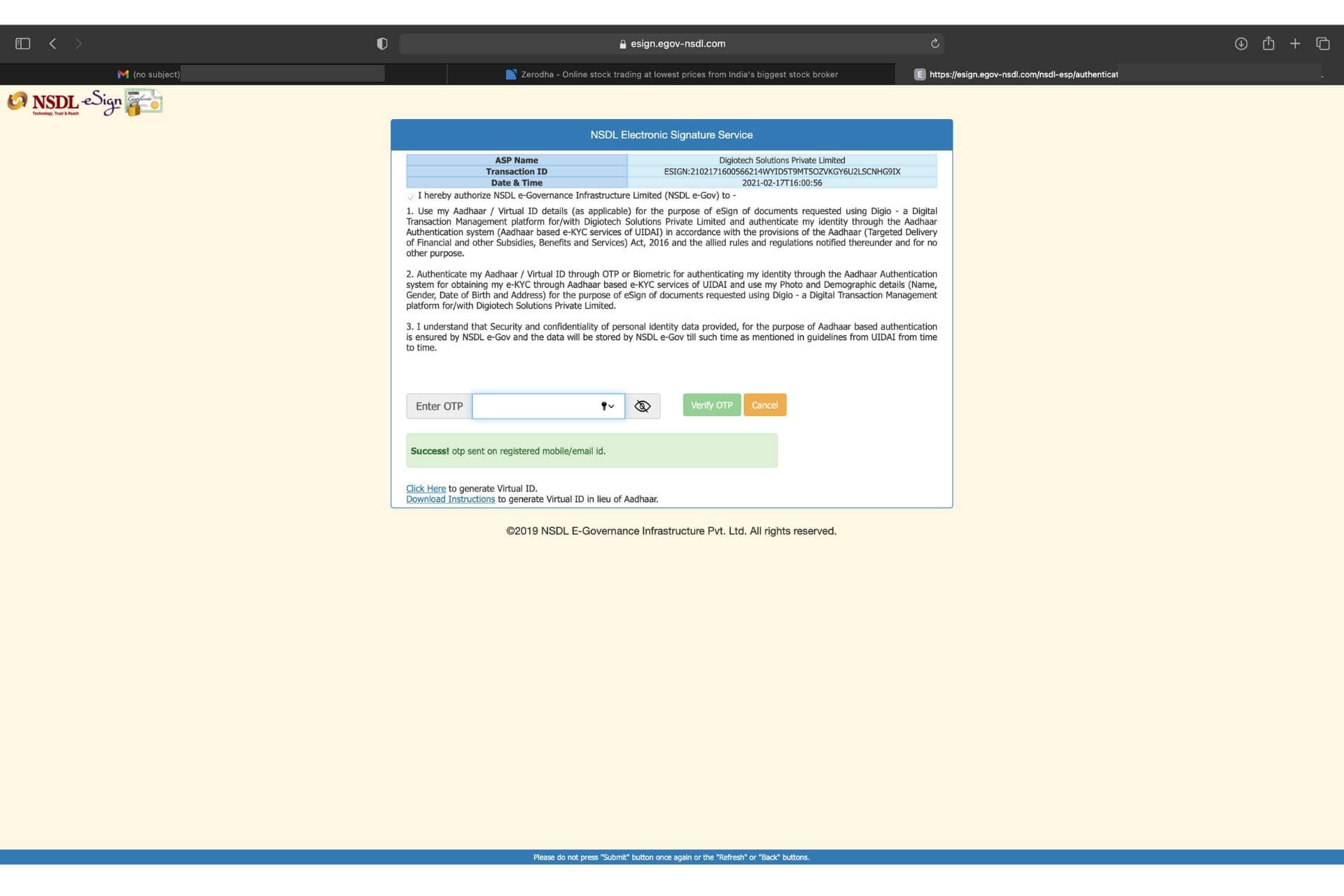

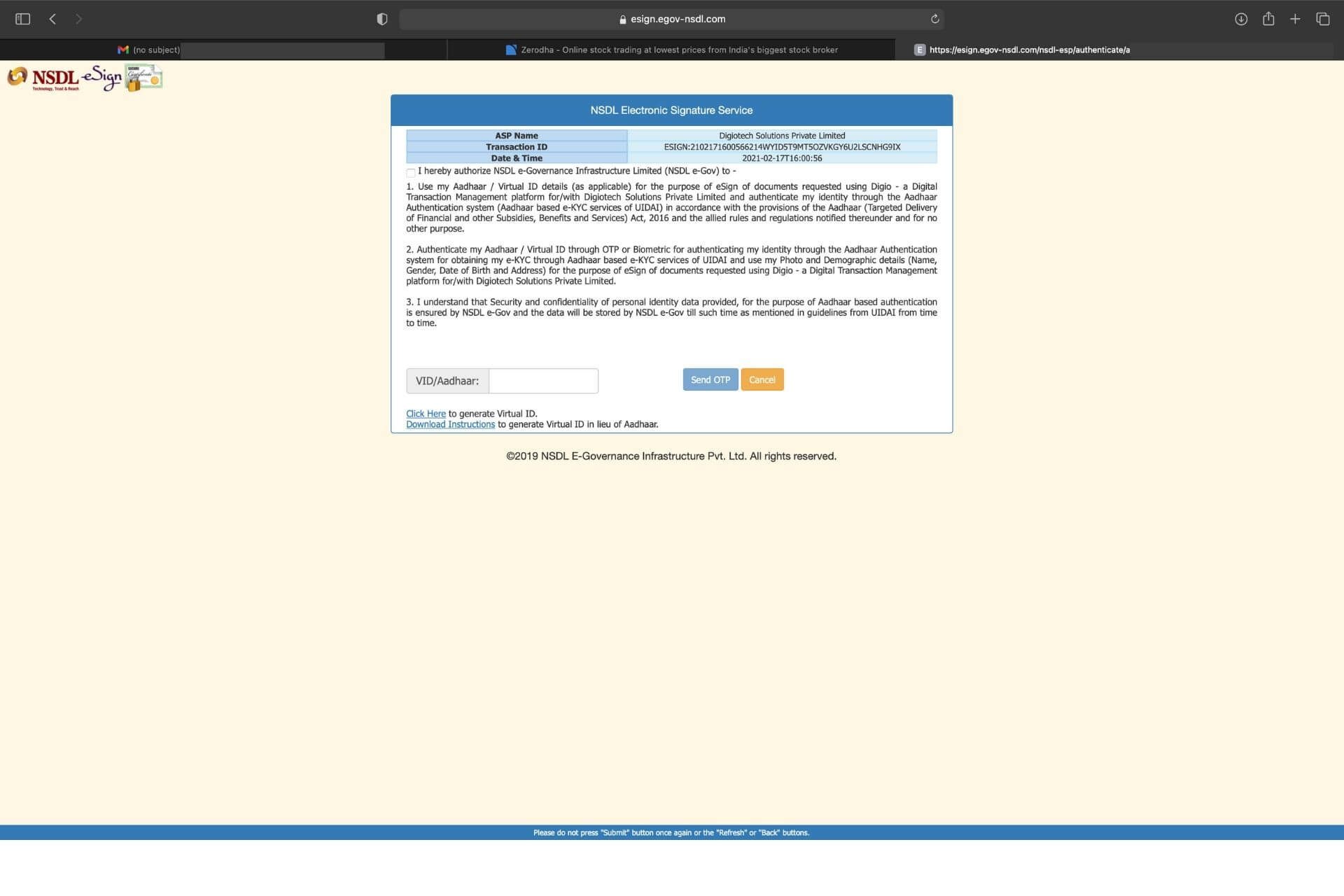

Once your email is verified, a new page will open with the “Sign now” button. Click on that button, and it will take you to the NSDL page.

11. Complete the eSign Process

On the NSDL page, check the box at the top left. Then, enter your AADHAR number at the bottom and click on Send OTP. Finally, enter the OTP to verify.

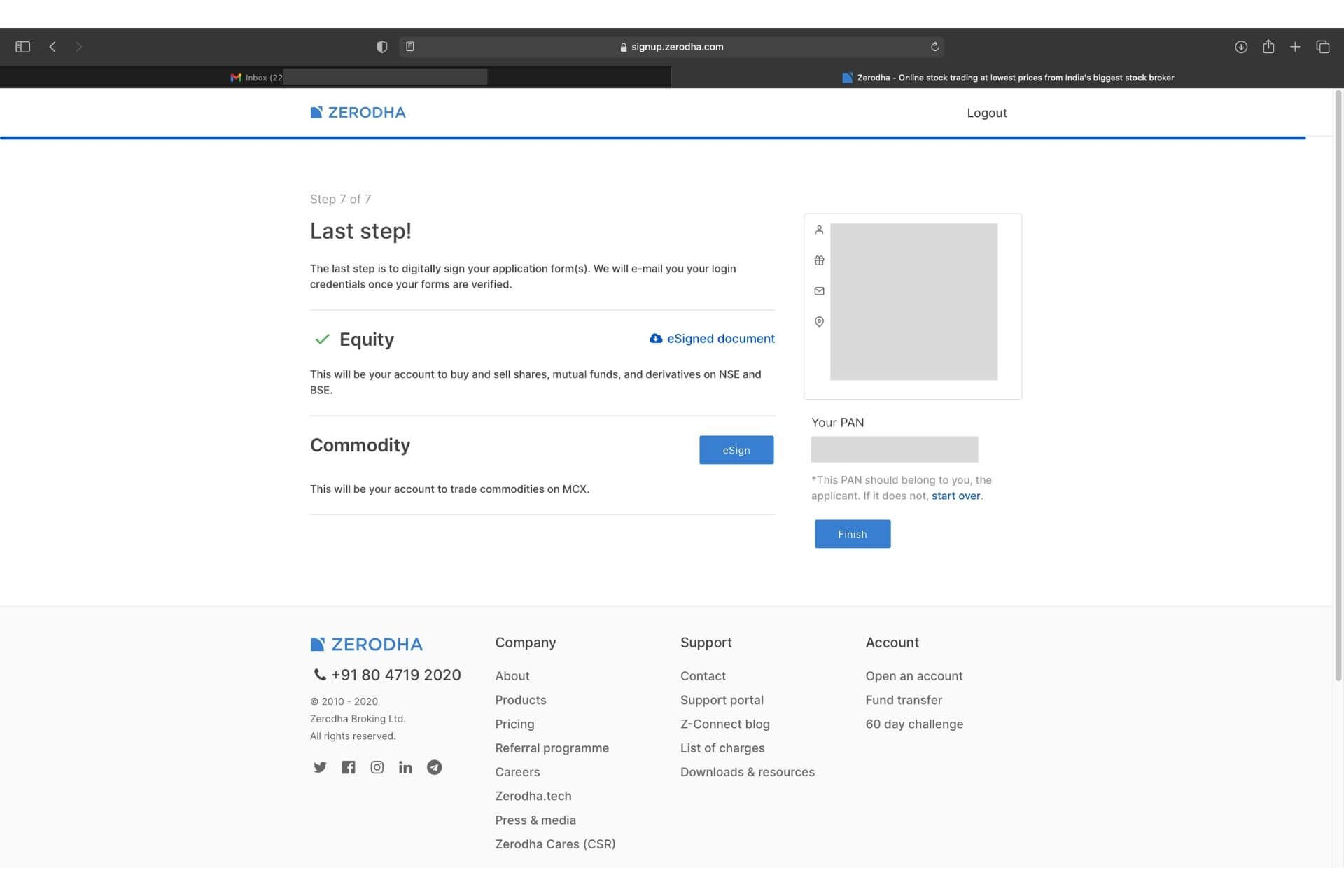

12. Equity eSign is completed

You will see a tick mark on the Equity segment, which means you have successfully signed up. You can also download the eSigned Document from this page.

13. Repeat for Commodity eSign

If you want to enable the commodity segment, you need to eSign again. Click on the commodity eSign, and it will take you to the NSDL page. Check the box at the top left, enter your AADHAR number, and you will receive an OTP on your AADHAR-linked phone. After entering and verifying the OTP, the documents will be eSigned for the commodity segment.

Process Completed

Congratulations! You have finished all the steps. A final message will appear on your screen once you complete everything.

Zerodha will review your application and documents. You’ll receive an email confirmation once your account is activated (typically within 24–48 hours).

The account will be opened within 72 working hours, and an email with the user ID will be sent. If the mobile number is not linked with the Aadhaar, the offline process of opening an account has to be followed. To learn more, see How to open a Zerodha account offline?

POA- Power Of Attorney (Not Mandatory)

This one-time consent that allows us to use his instructions while placing a sell order to debit shares from his Demat use this method only for shares sold worth up to Rs 25 lakh per day, per client, and across all his holdings.

If you do not wish to see the option of E-DIS while trading, then you will be required to courier the physical copy of the POA form to Zerodha Head office mentioned below.

Zerodha Corporate Head office:

Zerodha Broking Ltd

153/154, 4th Cross, Dollars Colony,

J.P Nagar 4th Phase,

Zerodha Offline Account Opening Process

Sometimes you may have not your aadhar card link with mobile no. In this case, you can opt for an offline Zerodha account opening process. You need to signup for offline account Opening by clicking on the link given above after filling this contact form Zerodha sales team will help you in account opening.

Now, you need to download Zerodha account opening form pdf & signing instruction from Link given below. You don’t need to fill up the details in the account opening form you just have to physically sign the form & attached documents, rest will be done by the Zerodha team.

You have to follow these simple steps to open an offline account.

Offline Zerodha Account Opening Documents

- You have to provide a self-attested PAN Copy.

- You have to attach a self-attested address proof, you can use any documents as address proof:

- Aadhaar Card

- Passport Copy

- Driving Licence

- Gas Bill

- Electricity Bill

- Bank Statement

- You have to provide valid bank proof for linking the bank account with Zerodha trading account

- Latest Bank Statement with IFSC and MICR mentioned on it – self-attested

- Personalized Cancelled Cheque with IFSC and MICR

- Bank Pass Book with IFSC and MICR – self-attested

- If you want to activate Futures and Options segment (Optional), then you have to provide a valid self-attested income proof, Income Proof Accepted:

- Latest 6 months bank statement

- Salary slip

- ITR Copy or Form 16

- Demat Holdings Statement

Then you need to print Zerodha offline account opening form after downloading & follow the signing instruction. Make sure you have signed in all the places required, i.e., all the F (first holder) boxes.

The account will be opened within 72 hours if the documents submitted are correct. If the account holder is a senior citizen and cannot sign the forms, a medical certificate and a thumb impression of the account holder on a sheet of paper must be sent along with the other documents.

Zerodha Broking Ltd

153/154, 4th Cross, Dollars Colony,

J.P Nagar 4th Phase, Bangalore – 560078

If you want to know about zerodha charges (brokerage charges, account opening charges) intraday margin & trading platforms & other features, You can read about this in detail in Zerodha Review.

If there is no discrepancy in the Zerodha account opening form your Zerodha account opening time is within 24-48 working hours after online or offline form submission.

Cheers!